Never.

There will always be a measure of risk when “investing” in Bitcoin, Ethereum, or any other cryptocurrency. However, that risk can be managed.

In this article, we’ll cover the fundamental points you need to know to make a risk-managed investment in cryptocurrency. But a word of warning: do NOT mistake “risk-managed” for “safe” because they are NOT the same thing. Keep reading to find out why.

How Cryptocurrency Investments Work

As with all things traded, digital coins are subject to supply and demand. At any given moment, there are people who have coins and want to sell them (supply) and there are people who want coins and are willing to buy them (demand). Combined, they comprise the coin market.

But not everyone agrees on the value of a coin. Every seller has a minimum price at which they’re willing to sell, and every buyer has a maximum price at which they’re willing to buy.

Sellers put their coins on the market at their willing prices, and prospective buyers buy them if the prices are low enough. As lower-priced coins are bought up, only the higher-priced coins remain on the market. As the price goes up, the number of willing buyers diminishes—and if buyers run out, sellers may need to start selling at lower prices. Thus, the price of a coin goes up and down as buyers and sellers enter and leave the market.

The current market price of a specific cryptocurrency is the price of the most recently sold coin.

So how do people make money with cryptocurrency? They buy in at a certain price, wait for the market price to rise, then sell for a profit. However, if the market price never rises above their buy-in price, then selling at a loss is the only option.

In this way, coin investing is similar to stock trading: each coin of a cryptocurrency is like a share in a publicly-traded company, and both coin prices and stock prices are determined by what buyers are willing to spend.

Why Cryptocurrency Investments Are Risky

A coin’s value is tied to how much faith people have in it.

If people really believe that a given crypto project is the future, then they’ll jump aboard the wagon: former non-buyers become buyers, and current buyers become willing to spend more to acquire coins. Sellers become emboldened to hold for the future and become less willing to sell at lower prices. The coin’s price shoots up.

Conversely, if people lose faith and stop believing in the longevity of a coin, then buyers back out and disappear. Sellers lose hope that their coins will be worth anything in the future, so they decide to dump—but they aren’t the only ones. Everyone ends up undercutting each other to offload their coins as fast as possible. The coin’s price plummets.

The problem is, increasing faith in a cryptocurrency is extremely difficult, and even hard-earned faith can evaporate overnight.

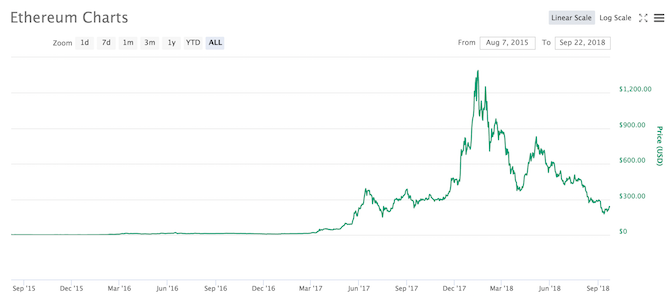

You’ve probably heard that you “need” to invest in cryptocurrencies “while you still can.” Buy now while the price is low so that you can sell when the price shoots back up! And based on the above price-over-time charts, you might be tempted to sink your savings into them. After all, look at those spikes!

If you had invested $1,000 into Bitcoin in January 2017, it would’ve been worth $18,000 in January 2018. If you had invested that same $1,000 into Ethereum in January 2017, it would’ve been worth a whopping $100,000. In just one year! You won’t find that kind of annual return anywhere else.

But high returns come with high risks.

January 2018 saw a huge price rally for nearly every cryptocurrency. If you bought in at these highs, you would have had a very worrying 2018, as the prices subsequently plummeted.

Spikes like this are common in the cryptocurrency world. As of this writing, CoinMarketCap shows over 1,900 different actively-traded cryptocurrencies, many of which experienced their own big spikes similar to what Bitcoin and Ethereum have gone through.

How did these cryptocurrencies fare?

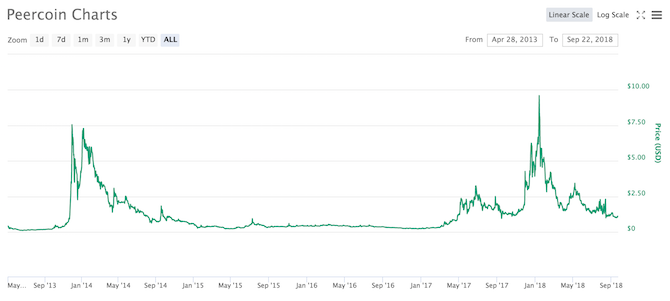

Peercoin became big around the end of 2013, skyrocketing in price through the first quarter of 2014 before users lost faith. The price dwindled down and down, with a few hopeful spikes along the way. The price spiked again in January 2018, when the whole market rocketed, but Peercoin failed to sustain this momentum and dwindled once again.

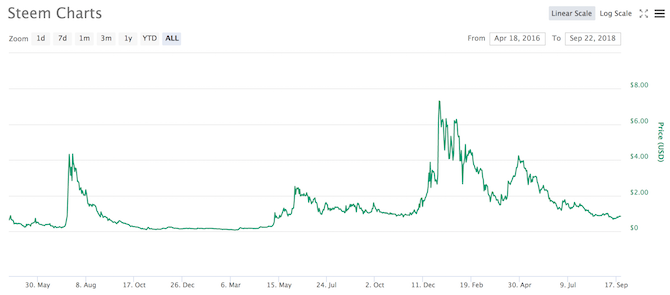

Steem is a younger cryptocurrency, just over two years old as of this writing, that exhibits much of the same patterns as older cryptocurrencies: the price sits stagnant for a quite, a spike comes along, users jump on the wagon, realize the hype wave is over, then sell out before the price plummets. Spikes happened in 2017 and 2018, but none have had a lasting impact on the price.

The same thing happened with Dogecoin, which was once the third-largest cryptocurrency in 2014 but is now barely hanging on in the Top 20. Dogecoin is one of the rare examples of a cryptocurrency that spiked to a higher price later in its life, but note how quickly that spike dissipates: it plummets, spikes again, then loses most of its gains within two months.

And that’s the big risk with cryptocurrency investments: you can get rich overnight, but you can also lose it all overnight. Don’t think of it as an investment—it’s a gamble.

Cryptocurrency investment is a game of spikes. You need to already be in the game by the time a spike arrives in order to ride it up for profits. At the same time, you need to get off that ride before everyone else does, otherwise they’ll run away with the profits and leave you empty-handed.

How is crypto investment different from the stock market?

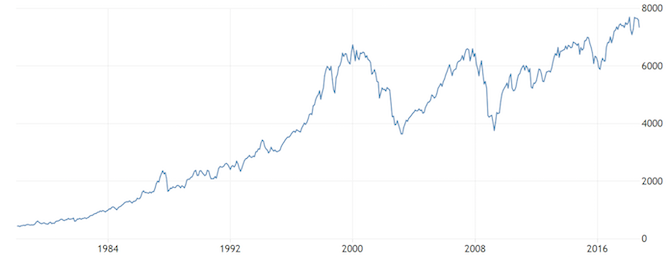

The main issue is a lack of historical data. Cryptocurrencies debuted with Bitcoin in 2009, which means the crypto market hasn’t even been around for a decade. Enthusiasts look at the 2017 spike in crypto interest as a sign of a healthy future, but there’s just no way to know for sure.

When you look at the US stock market’s history (as shown above), you see all kinds of peaks and valleys, but you also see an upward trend over the long term. We can’t say the same for cryptocurrencies.

Could the US stock market crash and never recover? Sure. It happened to Japan in 1990. But the historical data shows that it’s unlikely. When there’s a crash, you can reasonably hope for a recovery.

There’s no basis for such a hope in cryptocurrency. Could Bitcoin, Ethereum, or any other cryptocurrency soar to higher heights over the next five years? Of course. But could the whole industry collapse and disappear? Absolutely. We simply don’t have enough historical data to do more than guess. It’s still too young and there’s too much uncertainty.

My rule of thumb: if you see a spike in cryptocurrencies, you’ve already missed the hype train. Wait for it to drop, buy in, and hold for another spike—but with the understanding that another spike may never come.

Managing Risk When Investing in Crypto

I’m not saying you shouldn’t invest in cryptocurrencies, but it’s clear that the market is alive and people can still walk away with a killing if they play their cards right.

That being said, here are a few tips to lessen your risk of a total loss:

Don’t put all your eggs in one basket. Don’t stick your entire life savings in cryptocurrency. Unless you’re willing to gamble, crypto shouldn’t be more than 5 percent of your total investment portfolio. And when you do invest in crypto, don’t dump it all into one coin. Diversify between coins that have different missions and different underlying technologies.

Only “invest” money you can afford to lose. Again, cryptocurrencies aren’t really investments—they’re speculations. It’s literally a gamble right now. Expect to lose everything and consider it a bonus if you don’t.

Sell your profits. If you make gains, don’t get greedy. Sell a portion of it to realize profit immediately, then see how the remainder performs. If it goes up again, sell another portion. Don’t “wait for the peak” before you sell—a plunge to zero could wipe you out overnight.

Never store your coins on an exchange. Another Mt. Gox controversy could be right around the corner. Have money on an exchange? Spend it or pull it out. Have coins on an exchange? Transfer them to a cold wallet for secure storage.

Read the full article: When Is the Safest Time to Invest in Cryptocurrency?

from MakeUseOf https://ift.tt/2CDKAZS

via IFTTT

0 comments: